Insight report, Freddie Mac economists have looked at how rising

mortgage interest rates could impact the housing market, as well as what ripples past increases have caused.

“History has shown that periods of rising mortgage rates can be challenging for U.S. housing and mortgage markets,” said Len Kiefer, Deputy Chief Economist, Freddie Mac. “In historical episodes of rising rates, home sales slipped, housing starts stalled, and mortgage originations swooned.

Home builders are doubly affected by increasing mortgage rates because they use financing to fund construction costs.

When interest rates on funding for new construction and mortgage rates rise simultaneously, home builders are squeezed by a fall in demand and an increase in costs. However, though rates have moved higher recently, mortgage credit is still historically cheap if borrowers can get in while the getting is good.”

So where does Freddie project mortgage interest rates to go in 2018, and what would the impact of those changes be? The Insight report says that if rates continue to hover between 3.5 and 4.5 percent and inflation remains low, originations, home sales, and housing starts should each increase by 5-10 percent this year.

If, on the other hand, rates spike by 1.5 percentage points, Freddie forecasts originations to fall by 30 percent, with home sales and starts also ping between 5-11 percent.

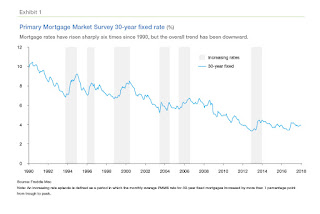

Exhibit 1 contains a plot of the 30-year fixed rate, with the shaded periods denoting the increasing rate environments. Since 1990, no episode has matched the magnitude of rate increase of the late 1970s. The largest increase was 2.4 percentage points from October 1993 to January 1995.

Kiefer asks, “If rates rise, will housing markets follow the historical precedent, or will they buck the trend and maintain momentum?

It's uncertain, but with a solid labor market, rising household incomes, and a demographic tailwind from a large young adult population coming of age, U.S. housing markets could show modest growth this year even with higher mortgage rates.'

mortgage interest rates could impact the housing market, as well as what ripples past increases have caused.

“History has shown that periods of rising mortgage rates can be challenging for U.S. housing and mortgage markets,” said Len Kiefer, Deputy Chief Economist, Freddie Mac. “In historical episodes of rising rates, home sales slipped, housing starts stalled, and mortgage originations swooned.

Home builders are doubly affected by increasing mortgage rates because they use financing to fund construction costs.

When interest rates on funding for new construction and mortgage rates rise simultaneously, home builders are squeezed by a fall in demand and an increase in costs. However, though rates have moved higher recently, mortgage credit is still historically cheap if borrowers can get in while the getting is good.”

So where does Freddie project mortgage interest rates to go in 2018, and what would the impact of those changes be? The Insight report says that if rates continue to hover between 3.5 and 4.5 percent and inflation remains low, originations, home sales, and housing starts should each increase by 5-10 percent this year.

If, on the other hand, rates spike by 1.5 percentage points, Freddie forecasts originations to fall by 30 percent, with home sales and starts also ping between 5-11 percent.

Exhibit 1 contains a plot of the 30-year fixed rate, with the shaded periods denoting the increasing rate environments. Since 1990, no episode has matched the magnitude of rate increase of the late 1970s. The largest increase was 2.4 percentage points from October 1993 to January 1995.

Kiefer asks, “If rates rise, will housing markets follow the historical precedent, or will they buck the trend and maintain momentum?

It's uncertain, but with a solid labor market, rising household incomes, and a demographic tailwind from a large young adult population coming of age, U.S. housing markets could show modest growth this year even with higher mortgage rates.'

No comments:

Post a Comment